Streamline Credit Lifecycles and Expedite Decisioning

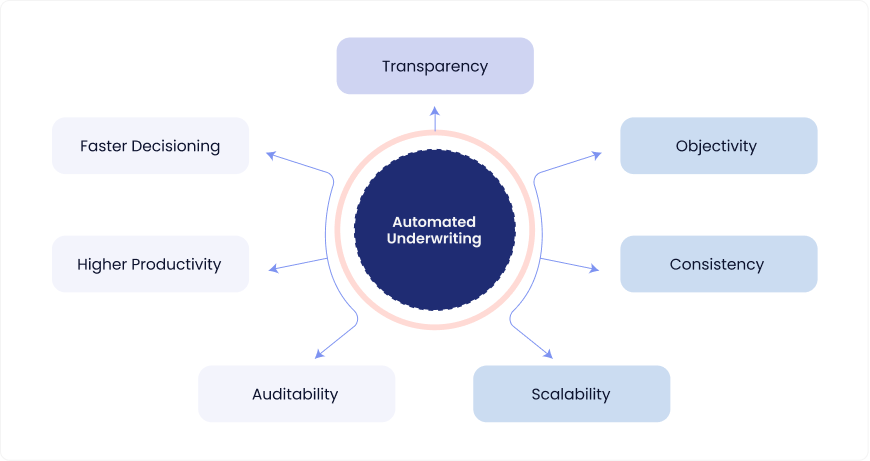

Use configurable logic to eliminate human bias

Improve underwriting transparency with automation

When underwriting decisions are based on manual interventions, there is a tendency for human bias to creep into the process. They also give rise to other concerns such as lack of transparency and a higher degree of risk exposure. An automated platform that is based on configurable logic overcomes these challenges and brings objectivity to the decisioning process.

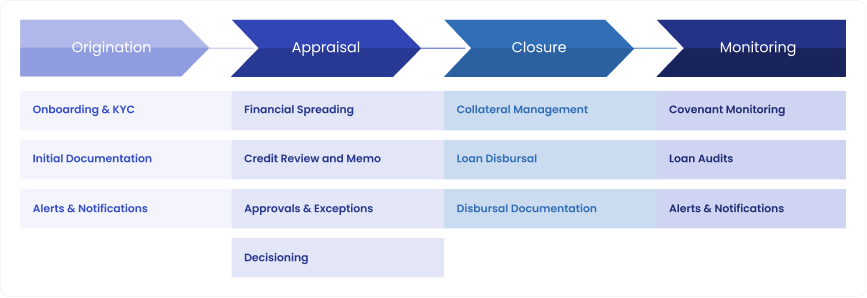

Integrate the borrower-lender journey on a centralized platform

Legacy loan processes are characterized by disparate systems and siloed processes, making them inefficient and time-consuming.

Typical processes comprising the underwriting lifecycle